the significance of cross-border payment services as a catalyst for international trade and business growth cannot be overstated. As a leading cross-border payment brand, SuperPay has been instrumental in driving cross-border payment solutions in emerging markets. Its commitment to offering secure, efficient, and diversified payment services has made it a game - changer in the global payment landscape.

SuperPay has strategically expanded its reach across numerous emerging markets. In Southeast Asia, where digital payment adoption is skyrocketing, SuperPay has integrated with local e - wallets like GrabPay and other popular regional payment methods. This allows businesses to seamlessly engage with consumers who prefer local payment options.

In the Middle East, SuperPay has adapted to the local market by supporting multiple currencies and integrating with widely - used payment methods such as STCPay. This adaptation not only meets the cross-border payment demands of Middle Eastern businesses but also caters to the region's booming e-commerce sector.

In Latin America, especially in countries like Brazil, SuperPay has played a crucial role in supporting the cross-border trade activities of local businesses. By providing multi - currency and cross - border settlement services, SuperPay has helped Brazilian businesses overcome the complexities of international payments, enabling smoother transactions with global partners.

SuperPay has also entered the African market, with plans to support local payment methods such as M - Pesa in Kenya. This move has the potential to significantly impact financial inclusion and the growth of cross-border e-commerce in the region.

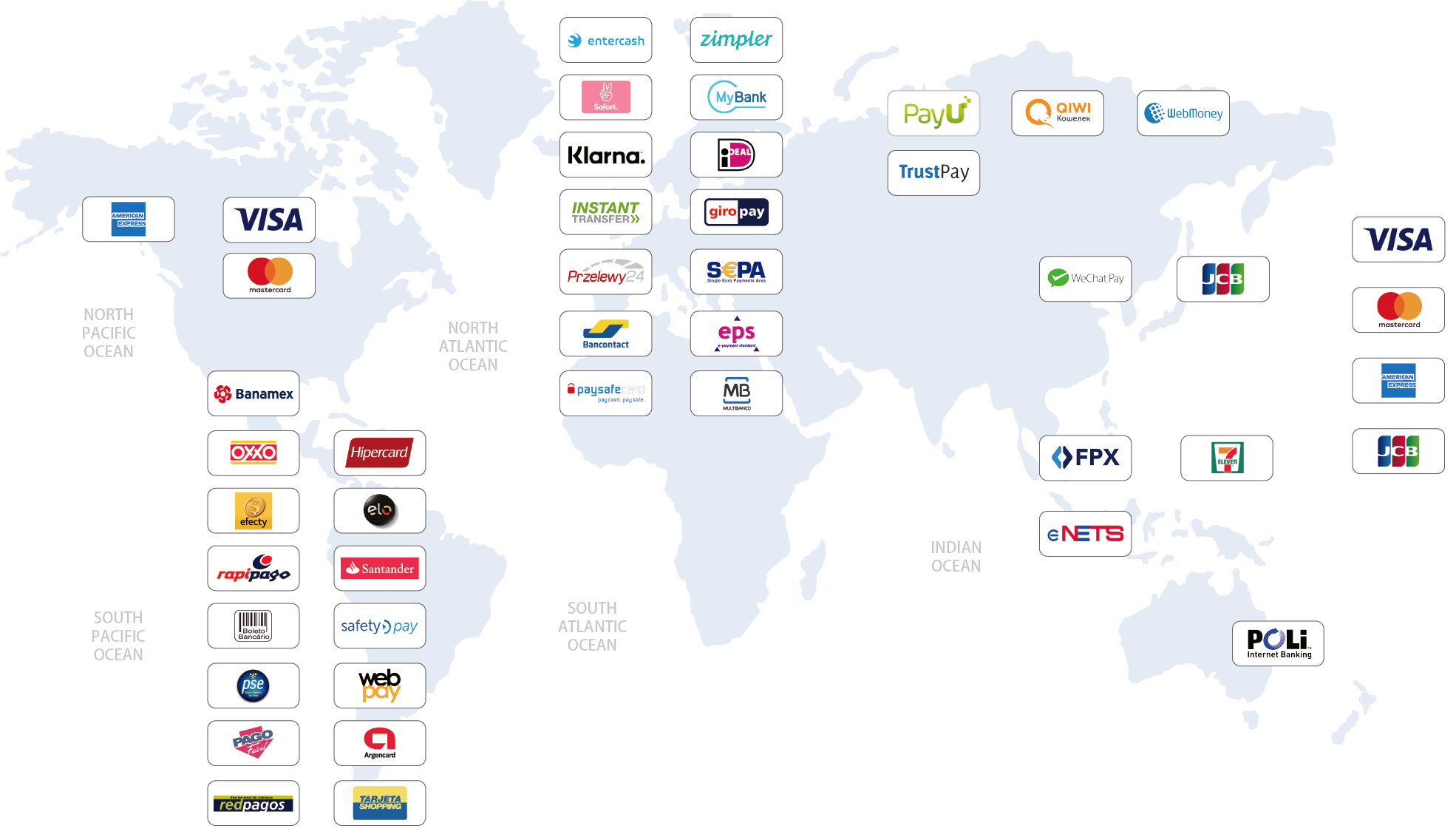

SuperPay offers a wide range of services to meet the diverse needs of businesses in emerging markets.