Dynamic Market, Great Potential

Japan's cross-border payment market is booming, driven by its position as a global economic powerhouse and growing international trade. With a large consumer base and a penchant for high-quality products and services, demand for cross-border payments is on the rise.Diverse Payment Methods.

Credit Cards: Widely used in Japan, major brands like Visa, MasterCard, and JCB are globally accepted, making them a reliable choice for cross-border transactions.

Electronic Wallets: Popular in Japan, with PayPay, LINE Pay, and others expanding into cross-border services. These wallets offer convenience and security for both online and offline payments.

Bank Transfers: A trusted method for large transactions, though they can be slower and incur higher fees compared to other methods.

Convenience Store Payments: Unique to Japan, this method involves paying for online purchases at convenience stores. It provides a cash-based option for those less comfortable with online payments.

Cross-Border QR Code Payments: Set to grow with Japan's planned interconnection with ASEAN countries' systems from 2025. This will make cross-border transactions more efficient and accessible.

Government Policy Support

Consumption Tax Reform: Since October 2019, Japan has imposed an 8% consumption tax on overseas e-commerce sales. From April 2025, digital services like e-books and software subscriptions will be included in platform-managed consumption tax collection. Foreign sellers must now collect and remit a 10% tax, aiming to create a level playing field for domestic and international businesses.

Customs Declaration Simplification: Japan Customs has introduced a simplified electronic declaration system to speed up the clearance process for cross-border e-commerce goods.

Cross-Border Remittance Fee Exemption: To encourage international financial exchange and cross-border e-commerce, Japan has implemented a policy exempting cross-border remittances from fees when conducted through designated channels. This reduces costs and boosts the growth of cross-border transactions.

Market Opportunities and Trends

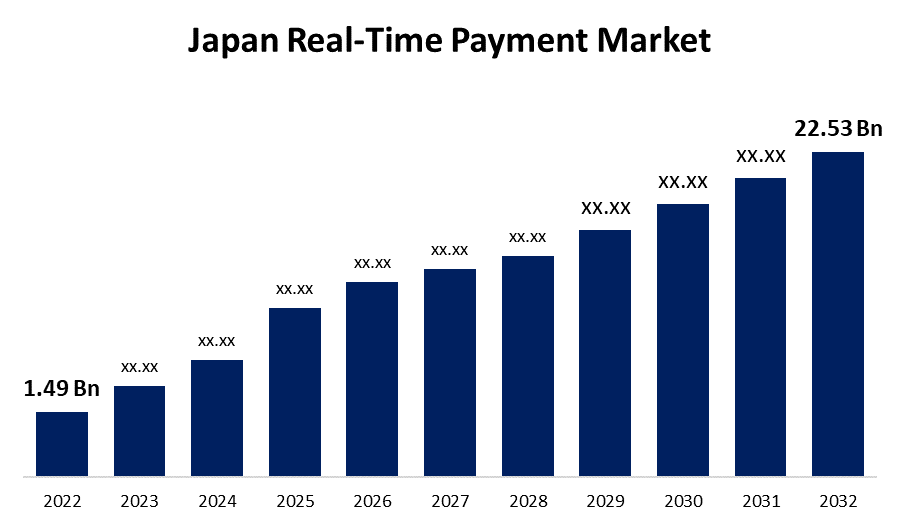

E-commerce Growth: Japan's e-commerce market is projected to reach 28.2 trillion yen by 2025. Cross-border e-commerce is set to benefit from this growth, with increasing consumption driving demand for cross-border payment services.

Tourism Revival: As tourism recovers, more foreign visitors are expected to use cross-border payment services for shopping, accommodation, and other expenses. This presents an opportunity to enhance payment convenience for tourists.

Digital Transformation: Japanese consumers are increasingly adopting digital payment methods, creating opportunities for cross-border payment innovation. Payment service providers can capitalize on this trend by offering user-friendly digital payment solutions.

Aging Population and Silver Economy: With a significant aging population, there is a growing demand for cross-border payment services catering to the elderly. This includes payments for healthcare products and retirement services.

The Role of SuperPay

SuperPay can play a significant role in Japan's cross-border payment market by offering secure, efficient, and diversified payment solutions. Its advantages include:

Multi-currency Support: Supporting multiple currencies to meet the needs of businesses and consumers in different countries and regions.

Local Payment Method Integration: Supporting popular local payment methods such as PayPay and LINE Pay to enhance the payment experience for Japanese users.

Strong Security Measures: Implementing advanced security technologies to protect transaction information and funds.

Professional Customer Service: Providing professional and efficient customer service to address issues and inquiries from businesses and users.

In conclusion, Japan's cross-border payment market is full of opportunities. With the support of government policies and the growing demand for cross-border payments, there is significant potential for development. SuperPay, with its strengths and innovative spirit, is well-positioned to excel in this market and contribute to its growth.